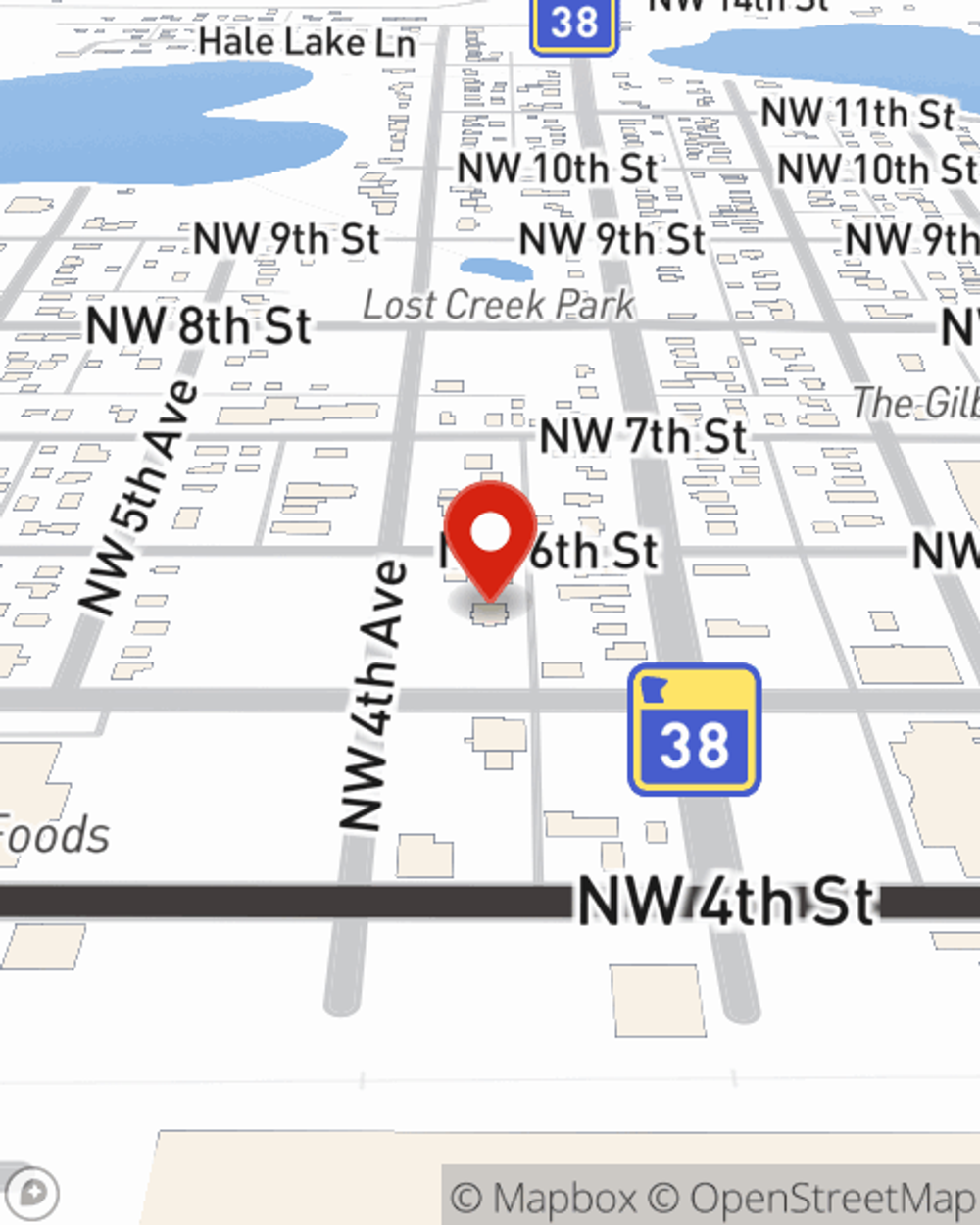

Business Insurance in and around Grand Rapids

Looking for protection for your business? Search no further than State Farm agent Terry LaValle!

Almost 100 years of helping small businesses

- Grand Rapids

- Cohasset

- Itasca County

- Hill City

- Deer River

- Coleraine

- Remer

- Longville

- Crosby

- The Iron Range

- 1,000 Lakes

- Northome

- Duluth

- Aitkin

- Saint Louis County

- Bovey

- Twin Cities

- Cass County

- North Dakota

- South Dakota

- Iowa

- St Paul

- Minneapolis

- Hennepin County

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like extra liability coverage, a surety or fidelity bond and worker's compensation for your employees, you can feel secure knowing that your small business is properly protected.

Looking for protection for your business? Search no further than State Farm agent Terry LaValle!

Almost 100 years of helping small businesses

Cover Your Business Assets

Whether you own a lawn care service, an antique store or a toy store, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Contact agent Terry LaValle to learn more about your small business coverage options today.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Terry LaValle

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.